In Support of the Austrian Business Cycle Theory

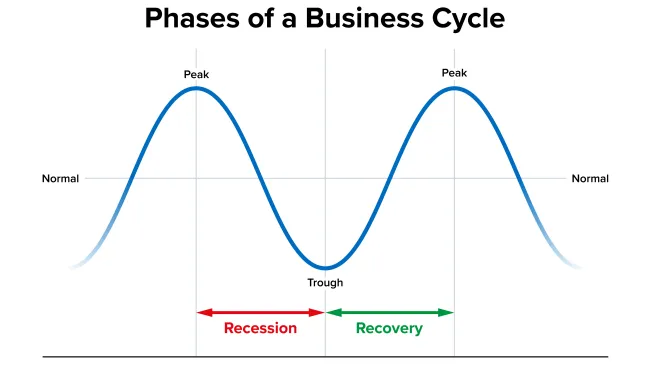

Critics of the Austrian Business Cycle Theory claim that capital investors over time will no longer be fooled by artificially-low interest rates triggered by central banks. However, when central banks push easy money policies, the inflation itself sets the ABCT pattern in motion.