Volume 16, No. 3 (Fall 2013)

ABSTRACT: Economist Fritz Machlup took a unique goals-assumptions-opportunity costs approach to the examination of alternative monetary reform plans. During the Bellagio Group conferences he, and co-leaders Robert Triffin and William Fellner, convened to bring monetary economists and officials from the G-10 countries together for an examination of alternative plans, Machlup defined monetary system reform in terms of goals; specifically, liquidity, adjustment and confidence, in terms of the assumptions underlying plans to achieve them and in terms of the opportunity costs of alternative plans. For the G-10 countries that had put $6 billion on the line in 1962 to protect IMF members (and some non-members) from financial crisis, the stakes were high. Machlup raised the bar: the issue was not just the cost of the opportunity forgone, but the cost of being wrong.KEYWORDS: opportunity costs, Bellagio Group, Fritz Machlup, financial crisis, liquidity, adjustment, confidence

JEL CLASSIFICATION: B250, E520, F330

Economist Fritz Machlup took a unique goals-assumptions-opportunity costs approach to the examination of alternative monetary reform plans. During the Bellagio Group conferences he, and co-leaders Robert Triffin and William Fellner, convened to bring monetary economists and officials from the G-10 countries1 together for an examination of alternative plans, Machlup defined monetary system reform in terms of goals—specifically liquidity, adjustment and confidence, in terms of the assumptions underlying plans to achieve them and in terms of the opportunity costs of alternative plans. Each of the Bellagio Group members, 32 non-governmental economists from the G-10 (currently academics with prior public policy experience) defined liquidity, adjustment and confidence and worked through the assumptions underlying four major monetary system reforms, including the institutions and operational requirements of each. The approach was systematically carried though over the course of four conferences occurring in 1963 and 1964 and institutionalized in the group’s approach to conferences with leaders2 of the G-10 countries, bankers and corporate strategists from 1964–1977. The process would turn policy regime opponents into collaborators for greater liquidity, adjustment and confidence. It would force participants to consider the (opportunity) cost of what Machlup called “getting it wrong.”

Eyewitnesses to Machlup’s efforts to bring competing exchange rate policy advocates together for debate attribute novelty, power and influence to his approach. Robert Triffin (1960) said that it was Machlup’s influence over economists that turned the tide towards flexible rates (Triffin, 1960, p. 8). Former historian of the IMF Margaret DeVries (1987, p. 80–81) said that that it was Machlup and the Bellagio Group’s focus on adjustment, liquidity and confidence that distinguished their arguments and made them so persuasive. Machlup’s contribution to framing the discussion in terms of adjustment, liquidity and confidence is echoed by G-10 leader and Bundesbank president Otmar Emminger (1978, p. 175): “Machlup… simplified the discussion on reform by clearly isolating three problems; ‘adjustment,’ ‘liquidity,’ and ‘confidence,’ that is, 1) what to do in order to improve, and facilitate, the adjustment of persistent payments imbalances, 2) what to do in order to provide for an orderly increase in needed monetary reserves in the world and 3) what to do to prevent currency crises and massive destruction of international liquidity due to a loss of confidence in the reserve currencies.”

Robert Solomon, a member of the Federal Reserve and American representative on the Ossola Group of the Group of Ten, said of the work of the thirty-two economists of the Bellagio Group, “One can discern [in their work] two areas of divergence from the content of the reports of the Group of Ten and the IMF. More stress was placed on the desirability of changing exchange rates as a means of balance of payments adjustment. And more concern was expressed about the instability that could arise from the “overhang” of foreign exchange reserves. (In general the report of the Bellagio Group holds up well in the light of subsequent developments.)” (Solomon, 1977, p. 71).

Gottfried Haberler, a member of the Bellagio Group, also attributed to Fritz Machlup and the Bellagio Group a focus on adjustment, liquidity and confidence. “The problems were set out in these terms in International Monetary Arrangements: The Problem of Choice, Report on the Deliberations of a International Study Group of Thirty-Two Economists…. The initiator and organizer of the study group was Fritz Machlup. In later years the work was continued in numerous meetings of the so-called Bellagio Group under the direction of William Fellner, Robert Triffin and Fritz Machlup” (Haberler, 1977, p. 21).

Triffin (1978, p. 149) acknowledged the strong appeal of the ferreting out of assumptions (and values) underlying policy recommendations, as well as the defense and cross-examination approach of the Bellagio Group meetings:

The assumptions and “hunches about the future” brought out to explain and justify our recommendations were unsurprisingly predictable. Proponents of a semiautomatic gold standard or of unmanaged floating rates both distrusted government interference in economic life, but the former felt confident that downward price and wage adjustments could be enforced by proper monetary policies “without undue hardship,” while the latter stressed that downward price and wage adjustments would entail wasteful and intolerable levels of unemployment. National “monetary sovereignty” was a favourite argument of the opponents of radical reforms as well as of the proponents of flexible rates. Those favouring a centralization of reserves were more sceptical of the virtues of national sovereignty in an interdependent world, and more concerned about the ability of reserve currency centres to export their own inflation to the rest of the world.

There is also an opportunity cost focus in the Bellagio Group discussions which heightens their importance. While Machlup had hinted at opportunity costs in “A Note on Fixed Costs” (1933–1934, p. 561) and addressed opportunity costs in “Eight Questions on Gold” (1941), “Competition, Pliopoly and Profit” (1942), and The Production and Distribution of Knowledge in the United States (1962), he comes close to the viewpoint shared at the Bellagio Group conferences in his paper “Can There Be Too Much Research” (1958). Machlup writes: “It is the economist’s task to analyze what alternatives society will have to forego when it does what seems so desirable to many or to all. The social cost of what is done is the value of what might be done instead. In technical terms, the social cost of any action is equal to the value of the most valuable alternative opportunity that has to be foregone.” (Machlup, 1958, p. 1321). Here he is very much in the spirit of Wieser’s later works, beginning with Social Economics (1914), an ambitious attempt to transcend economic theory and apply his ideas to real human society and Mises’s Human Action (1949). According to Mises, “costs are equal to the value attached to the satisfaction which one must forego in order to attain the end aimed at” (p. 97), and “Costs are the value attached to the most valuable want-satisfaction which remains unsatisfied” (p. 393). In their final Report on the Deliberations of a International Study Group of 32 Economists, Machlup and the Bellagio Group let the G-10 and the IMF know just how high they knew the stakes were: “The fact that diagnosis is uncertain also forces us to recognize another question—one faced by all who must make decisions in the face of uncertainty. What is the cost of being wrong? ...What are the costs and benefits involved in initiating a process of adjustment that may turn out to be premature or entirely unnecessary, as compared with the costs and benefits of delaying or failing to initiate one that may prove to be necessary?” (International Monetary Arrangements, 1964, p. 52–53).

Machlup was right: there were so many ways to get it wrong. Machlup had identified some of these in his papers: confusing an accountant’s view of payments balance with a supply and demand view, or with a nation’s hopes and dreams view (“Three Concepts of the Balance of Payments and the So-called Dollar Shortage, 1950); applying a value judgment to balance of payments disequilibrium (“Equilibrium and Disequilibrium: Misplaced Concreteness and Disguised Politics,” 1958) or to liquidity (“The Fuzzy Concepts of Liquidity, International and Domestic, 1962); misunderstanding how what is included or excluded and where it shows up in a balance of payments calculation affects balance (“The Mysterious Numbers Game of Balance-of-Payments Statistics,” 1964); and the opportunity cost versus psychological value of reserve assets (“The Need for Monetary Reserves,” 1966).

Machlup would build this opportunity cost consideration into group discussions and survey methodology.

The purpose of this paper is to shed light on Machlup’s framing of liquidity, adjustment and confidence in an opportunity cost context at the Bellagio Group conferences. Section I introduces group process and method at the Bellagio Group conferences. Section II addresses the questions about how were liquidity, adjustment and confidence defined; what was the interrelationship between these issues; and what value conflicts they raised? Section III returns to the discussion of alternative monetary reform plans and addresses the question of what the specific opportunity costs are of different approaches to the “liquidity problem” or the “confidence problem” as discussed by the Bellagio Group. The discussion in this section is aligned to a survey of members on their first and second best solutions to these problems. Section IV summarizes the survey results, and Section V draws conclusions. The four initial Bellagio Group conferences would set the ground rules for 15 conferences to come, spanning 14 years and increasingly operating at the request of G-10 leaders who had come to think of the Bellagio Group and its methods as invaluable to the discussion of adjustment and special reserve assets.

I. THE BELLAGIO GROUP CONFERENCES:

INTRODUCTION, PROCESS AND METHOD

In 1963, against a backdrop of escalating worry (exacerbated by the signing by the G-10 of the General Agreement to Borrow) and irreconcilable reform plans, US Treasury Secretary and G-10 leader Douglas Dillon announced IMF and G-10 studies to establish the need for monetary system reform. When questioned about the absence of academic economists from the enterprise, Dillon said that academics had had their chance and could not agree on a solution. Machlup’s tongue-in-cheek response was to create a separate academic study group to focus on the sources of individual disagreement. Machlup, as well as William Fellner and Robert Triffin, who were with Machlup at the announcement of the official study groups, became co-leaders. The Bellagio Group would include academic economists from all G-10 countries, some of whom were also working on European integration while they worked on international monetary system reform. The latter included Jacques Rueff and Pierre Uri, among the French; German economists Herbert Giersch and Egon Sohmen; and Belgian economists Alexandre Lamfalussy and Robert Triffin. All but the youngest had played a public policy role before academia. Machlup intended that this group be considered a serious, experienced policy advisor to the G-10.

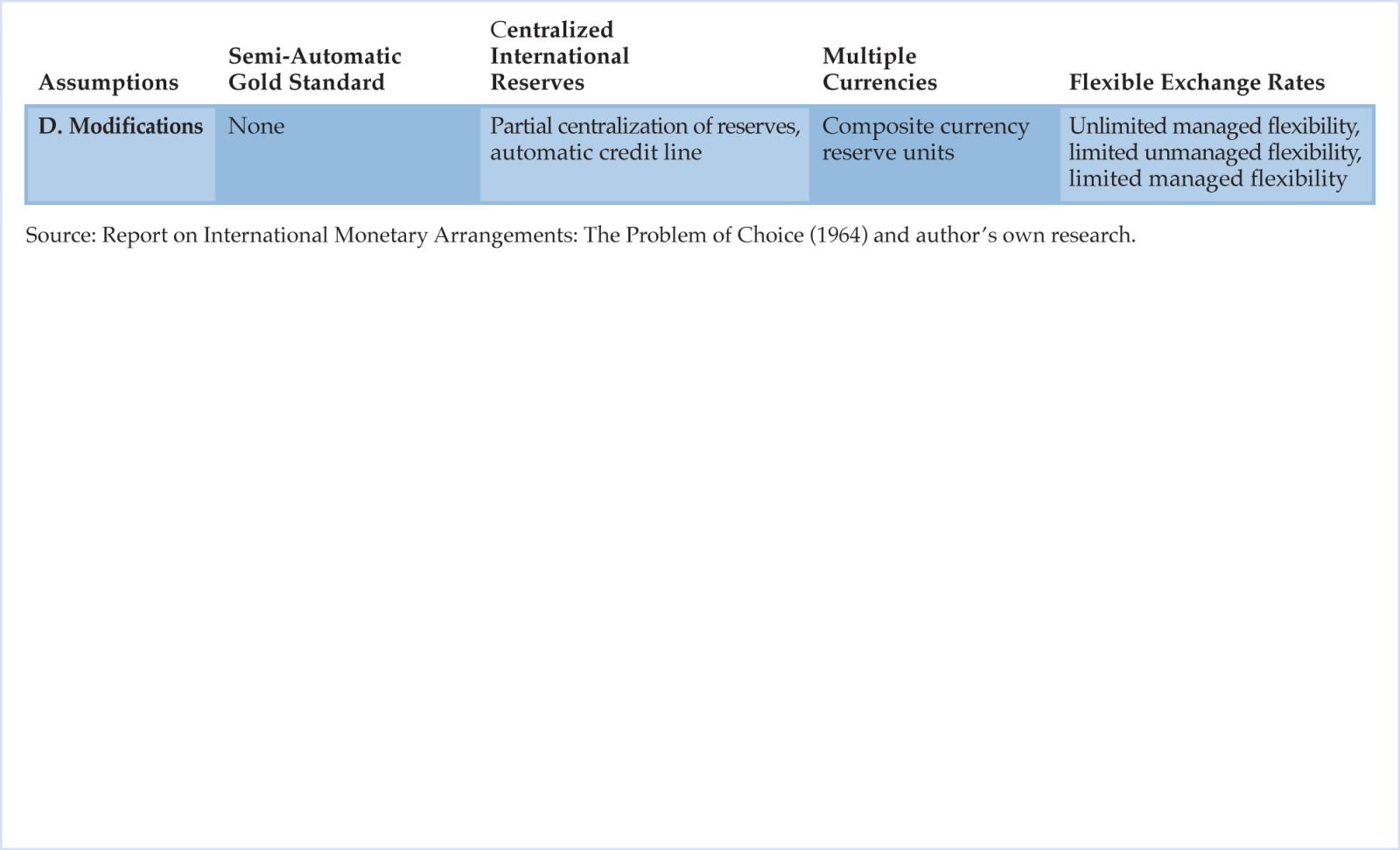

A series of four initial conferences was planned. The first, held in December 1963, was a test of the process using US-only academics and focused on a discussion of the objections to freely floating and fixed exchange rates. At a second conference, held from 17 to 23 January at the Villa Serbelloni in Italy, advocates of each of four alternative exchange rate regimes—status quo (semi-automatic gold standard); centralized reserves; multiple currency reserves and flexible exchange rates, were asked to enumerate the positive assumptions associated with their plan and the reasons they preferred their plan to alternative systems. Table 1 summarizes the major reform plans and sources of disagreement on a plan/assumptions level.

Table 1. Four Major Policy Proposals: Sources of Disagreement

The inquiry took the form of hearings: one or two protagonists were asked to submit to cross-examination by the rest of the group. It was, in general, Machlup’s practice to permit no transcript of the Bellagio Group conference conversations. We have insights into the meetings from economist Robert Triffin, who acknowledged, “Each of us had to defend his proposals against the criticisms of other participants and to explain why he could not agree with their proposals” (Triffin, 1978, p. 149). On the basis of notes taken during these sessions, drafting committees worked every night on the formulation of statements of assumptions made in the advocacy of each major policy system which, if accepted as pertinent, correct and realistic, would justify the adoption or adaptation of a particular system and the rejection or modification of the others (Triffin, 1978, p. 149).

At the end of the second conference, following a survey format, members were asked to define, explain and prioritize three problems: 1) the problem of adjustment, i.e. of correcting imbalances in payments positions (a problem that would become known as the adjustment problem); 2) the problem of the aggregate amounts of international reserves, i.e. of providing such amounts as would avoid inflationary and deflationary swings in the world at large (a problem that would become known as the liquidity problem); and 3) the problem of consolidation of reserves, i.e. of avoiding sudden switches between reserve media (a problem that would become known perhaps not so intuitively as the confidence problem).

Robert Triffin’s papers at Yale give us some flavor of the responses.

Canadian economist Robert Mundell would confirm that the problems of confidence, adjustment and liquidity were the three main problems under consideration, but he saw the confidence problem as the most serious threat to stability and the easiest problem to solve. In his view, the gold standard system involves both liquidity and adjustment features, which are inefficient; flexible exchange rates offer an obvious solution. By speeding adjustment they reduce the need for liquidity, and by the addition of a flexible instrument of policy they leave governments free to pursue full employment policies without the gimmickry associated with the current system. Closely integrated countries may still opt for intra-currency area pegged rates because common-currency adjustment methods remain efficient when factors are highly mobile, but the major currencies should let their rates float. (Triffin Papers, Yale University Archives, MS 874, Box 12, folder 1).

For US economist Peter Kenen, the need and size of reserves would depend on the size, frequency and duration of the balance of payments deficit. One cannot make judgments about reserves and the international monetary system until one has studied the process of adjustment. The need for reserves depends on the size, frequency and duration of disturbances afflicting the exchange rates and on the speed with which countries are willing and able to offset or combat those disturbances. In my view, however, we cannot and should not seek to devise a monetary system that imposes prompt and automatic adjustment—one that can bar governments from exercising discretion in their responses to payments disturbances. (Triffin Papers, Box 12, folder 1).

German economist Egon Sohmen tied balance of payments adjustment to the price mechanism. Over the long run, only the domestic price mechanism in each country can be safely relied upon to ensure balance of payments adjustment. If it does not, the level of employment, the freedom of international payments or the long-run stability of exchange rates will have to yield. The abandonment of any one of these policy objectives would have most undesirable consequences for the operation of the world economy. (Triffin Papers, Box 12, folder 1).

Swiss economist Jurg Niehans would make the strongest defence of Machlup’s frame. The various monetary projects put forward and debated in recent years do not all address themselves to the same problems. While from a purely academic point of view it might be interesting to analyze them as if each of them were meant to be a complete and self-contained solution to all our problems, from a practical point of view such an analysis would be in danger of being sterile. The various projects are, in fact, largely complements rather than substitutes.” (Triffin Papers, Box 12, folder 1).

By the third Bellagio Group conference (21–22 March 1964), conferees had further developed their position on the mechanisms necessary for payments adjustment. Planks included the continued addition to reserves in the hands of the international monetary authorities, and the importance of international reserve assets other than gold (“credit reserves”) whose volume, composition and policies regarding balance of payments problems would be coordinated by the monetary authorities of large reserve-holding countries. Conferees also agreed that stability of the international monetary system would be improved by agreement among the major countries on the long-run rates of change in total reserves held by participating countries and on the “normal” composition of these reserves; on the terms and criteria for extending special credit facilities to participating countries to cope with strains and crises resulting from international capital movements; and on the need to choose an international body to manage reserve use (e.g. International Monetary Fund, Group of Ten, etc.).

At the fourth conference (29 May to 6 June 1964), all members, organized into several drafting committees, participated in the drafting and redrafting of the final report.

The outcome of the fourth conference was a report, International Monetary Arrangements: The Problem of Choice: A Report on the Deliberations of an International Study Group of 32 Economists, quite literally prepared by all members of the Bellagio Group. Even after all of the drafts prepared during the conferences and the weeks between conferences, handwritten notes in the Machlup archives depict the final report to be another collaborative decision-making exercise. Tibor Scitovsky and Fred de Jong, Friedrich Lutz and George Halm shared responsibility for the Objectives section. Assigned to discuss the adjustment, liquidity and confidence issues were Fred Hirsch, Harry Johnson and the team of Jurg Niehans and Peter Kenen, respectively. The team of Robert Mundell, Hans Moller and Gottfried Haberler was assigned the section on “Relationships among the Three Problems – Objectives and Conflicts.” Even the final section, “Towards a Consensus on Policy” (originally called “Groping for a Consensus”), was drafted by Robert Triffin, Michael Heilperin and Alan Day (Triffin Papers, Box 12, folder 1).

II. LIQUIDITY, ADJUSTMENT AND CONFIDENCE: DEFINITION, INTERRELATIONSHIPS AND VALUE CONFLICTS

From the second through the fourth conference, every member of the Bellagio Group worked on the definition of the liquidity, adjustment and confidence problems as well as on the assumptions underlying their preferred plans for solving them. Consensus on definitions was mandatory for meaningful discussion. There were many arguments but the final definitions, interrelationships and value conflicts were set by the end of the fourth conference and became part of International Monetary Arrangements: The Problem of Choice, the final report issued in 1964 after the fourth conference, slightly in advance of the G-10 and IMF reports and shared with those groups.

The Problem of Payments Adjustment

The Bellagio Group defined adjustment as the process by which deficits and surpluses are eliminated. The classical method of adjustment consists in a fall of money incomes, wage rates, costs, and prices in the deficit countries relative to those in the surplus countries, brought about by a change in exchange rates between the currencies of the countries concerned or by changes in the absolute levels of money incomes, wage rates, costs, and prices in some or all of the countries (International Monetary Arrangements, 1964, p. 25). Under the orthodox gold standard (1871–1914), gold flows brought about these changes automatically. Under the gold-exchange standard (also known as the semi-automatic gold standard, 1946–1971), the automatic mechanism of adjustment had weakened and the readiness to use policy measures for adjustment purposes had resulted in the expansion of adjustment policy options.

The Problem of International Liquidity

For an individual country, “international liquidity” means, most commonly, the command of its monetary authority over foreign exchange for use in intervening in the foreign-exchange market to support the exchange value of its currency. By intervening, the monetary authority could delay or avoid (1) the adoption of the domestic economic policies that would be required to adjust the economy so as to restore immediate payments balance at the current exchange rate, or (2) the adjustments that would be brought about by a change in the exchange rate (International Monetary Arrangements, 1964, p. 29). For concreteness and precision, the conferees agreed to confine the concept of the international liquidity of a country to the sum of owned reserves and unconditional drawing rights. The international liquidity problem is the problem of reforming the international monetary system so as to provide for the growth of total international reserves at a rate consistent with the normal expansion of the world economy at a rate of growth which imposes neither inflationary nor deflationary pressures on world prices (International Monetary Arrangements, 1964, p. 31).

The Problem of Confidence

The term “confidence” referred specifically to the reserve media on which the monetary system was based and to the “overhang” of dollar and sterling claims held as reserves by other monetary authorities. Even if adjustment processes and the supply of international reserves proved to be quite adequate over the long run, the international monetary system might still be subject to massive shocks if major holders of reserves sought suddenly to substitute one international reserve asset for another or begin massive conversions of dollars into gold, whether by central banks or private outflows. In either case, such a move would destroy confidence in the reserve media being substituted with consequences for the adjustment mechanism as well as the global stock of reserve assets (International Monetary Arrangements, 1964, p. 35).

Interrelationships Between the Three Problems

The problems of payments adjustment, international liquidity, and confidence in reserve media are closely related. If the adjustment mechanism works fast, either automatically or speeded by policy measures, the need for liquidity is low. If the adjustment mechanism or adjustment measures work slowly, the need for liquidity is high. Conversely, the speed and character of adjustment are likely to be affected by the magnitude of the available reserves and the ease with which gross reserves can be replenished (International Monetary Arrangements, 1964, p. 36).

Liquidity and adjustment are also closely related to the question of confidence. As reserve-currency countries run deficits, gross liquidity increases, but confidence may after a point be diminished. On the other hand, as deficit countries undertake adjustment, liquidity may be re¬duced, but confidence enhanced. The action of a reserve-currency country in augmenting its own liquidity, through the generation of a balance- of-payments surplus, necessarily diminishes world liquidity while restoring world confidence in that reserve cur¬rency. The role of a reserve-currency country as provider of reserve assets may therefore conflict with its role as provider of a safe reserve asset (International Monetary Arrangements, 1964, p. 37).

Value Conflicts

While identifying personal freedom as a fundamental social objective, the Bellagio Group identified specific objectives in the economic sphere:

1. a high and stable level of employment;

2. the highest possible per capita income, requiring

(a) an efficient allocation of resources among countries as well as within them, and

(b) a high rate of growth; and

3. a continuing special regard for poorer persons and nations

Group members acknowledged that these objectives could conflict among themselves and could only be reconciled by compromise (International Monetary Arrangements, 1964, p. 39). Opinions differed on how best to reconcile them as members worked through monetary reform options.

III. LIQUIDITY, ADJUSTMENT AND CONFIDENCE—OPPORTUNITY COSTS OF DIFFERENT APPROACHES

Opportunity cost considerations arose as members differed on the appropriate mix of individual action and central control, on how much the individual’s freedom of decision should be encroached upon by government action, and to what extent sovereign national economic policies should be constrained in the interest of international cooperation, equity, and harmony. They disagreed on what they con¬sidered the best institutions and policies, and the best combination of institutions and policies on the national and international level, for the achievement of universally agreed-upon objectives.

Table 2, in the Appendix, “Adjustment, Liquidity and Confidence Mechanisms Preferred” summarizes the areas of disagreement at the program/tactic level and the specific Bellagio Group member associated with each. This table is based on Robert Triffin’s notes on Machlup’s survey taken after the fourth conference. It is limited to the twenty members who responded. Nevertheless, these members cross all four major reform plans. The discussion of adjustment, liquidity and conference issues below captures the major data from this table.

Very fundamentally, focus on the specific tactics by which adjustment, liquidity or confidence could be solved required thinking outside the silo of preferred regime change plan. As Jurg Niehans put it, “The real task… is to design a monetary strategy incorporating features of different plans at their appropriate place (Triffin Papers, Box 12, folder 1).

Adjustment

Adjustment discussions would reduce to three alternatives: no change from present system, faster and slower. Note that those desiring a deviation in the status quo to achieve faster domestic adjustment of payments imbalance cut across all four major reform plans: for example, Machlup (flexible exchange rates, at first unlimited, later managed), Dieterlen (unlimited flexibility), Malkiel (multiple currency reserves), Heilperin (return to gold standard, alternatively semi-automatic gold standard), Sohmen (flexible exchange rates, at first unlimited, later managed), Uri (centralized reserves), Haberler (unlimited flexibility), Day (centralized reserves) and Mundell (fixed rates).

Conferees who believed the bulk of all future payments imbalances would be shortlived or reversible preferred reliance on short-term financing from official reserves and the postponement of adjustment measures. Proponents of larger reserves or larger access to international credit to maximize the discretion of national authorities. These included Salant (multiple currency reserves), Harrod (semi-automatic gold standard) and Scitovsky (managed flexibility). In their view, adjustments in relative cost-price relations and in resource allocation would be wasteful as well as unnecessary. Some conferees also preferred reliance on financing even if imbalances were persistent or nonreversible. In this case long-term financing was preferred to adjustments in relative cost-price relations and in resource allocation because such adjustment measures sacrificed policy objectives, such as full employment or fast growth. Proponents of conditional credits granted only when deemed necessary by the international authorities included Triffin (centralized reserves), Salant (second best solution) and Hirsch (multiple currency reserves, first choice), Haeberler and deJongh (it was their first choice) and Scitovsky (managed flexibility; it was his second choice).

Like the advocates of freely flexible rates, advocates of a semiautomatic gold standard also regarded prolonged financing as undesirable. They believed that, in practice, it led not to gradual adjustment but to postponement of adjustment, permitting imbalances to grow and reach a point where the only possible remedies would involve greater interference with other policy objectives than would have occurred had the adjustment been initiated promptly and taken the form they advocate. They also tended to fear price inflation more than they feared failure to attain high employment and an accelerated rate of economic growth. Another important element in the opposition to larger provision for financing is the fear that the mere existence of large owned reserves or borrowing facilities would give rise to the danger of excessive monetary expansion in the world as a whole.

While most economists who favored flexible exchange rates (Machlup, Sohmen, and Halm, for example) saw the financing option as unnecessary because flexibility of exchange rates permitted cushioning by means of private short-term capital movements and thereby gradual adjustment without undue sacrifice of other policy objectives, others like Haeberler and Scitovsky believed that it was hardly possible to diagnose correctly the various types of disturbances at a sufficiently early stage and that irreversible mistakes will be made too often if the authorities attempted to determine on an ad hoc basis whether prolonged financing or prompt adjustment is appropriate, leading to possible error (International Monetary Arrangements, 1964, pp. 49–50).

Proponents of flexible rates recognized the danger that exchange-rate depreciation in response to a temporary disturbance might set in motion forces, partly political, that lead to an undesired rise in the general national price level and might induce unnecessary shifts in the allocation of labor and capital. They believed, however, that these dangers could be taken into account by internal monetary policy. Advocates of more scope for exchange rate adjustments without intervention within the margins included Machlup and Malkiel. It was also the second best solution of Sohmen and Scitovsky. Salant, deJongh and Dieterlen also favored this approach.

Assuming that full employment prevailed, the appropriate initial response of the monetary authorities to a disturbance tending to cause depreciation would be to tighten credit and cushion the original tendency toward depreciation in order to avoid a strong updrift of prices and a pressure for a shift of labor and capital that might prove excessive. If the disturbance did prove to be temporary, the monetary restriction could be stopped as the downward tendency of the exchange rate ended and was replaced by a movement back to its original level. If the disturbance persisted, the restric¬tion could be eased sufficiently to allow whatever further depreciation of the currency was necessary to combine external balance with reasonably full employment and stable prices. Proponents of more exchange rate adjustments through more frequent changes of the peg as well as revaluation and devaluation included Triffin, Hirsch, Moler, Kenen, Uri, Kojima, deJongh, Day and Scitovsky.

Both those who wanted no change in the fixed rate system and those who advocated some level of exchange rate flexibility saw the need for judicious use of monetary policy to secure external balance, as well as internal, through a variety of mechanisms. Note that all Bellagio Group members at this conference preferred more exchange rate flexibility for external adjustment to replace or supplement domestic adjustment. While the issue of trade or exchange controls was raised, no member voted for them.

In summary, the advocates of a semiautomatic gold standard and of flexible exchange rates tended to stress the costs of delaying adjustment, while the other conferees, as already noted, tended to stress the costs of rapid adjustment or of prompt initiation of it when, in fact, it might turn out to have been unnecessary. The sources of disagreement on this point—assuming that diagnosis of the causes of imbalance remained difficult and uncertain—lay in the factual judgment regarding the relative frequency with which the various types of disturbance are likely to occur in the future and in the appraisal of the costs and benefits resulting from risking incorrect courses of action.

Liquidity

Unlimited flexibility of exchange rates did not require reserves, which was the major issue behind the liquidity problem. Neither did the plans to increase or decrease the price of gold. The fixed rates (for all intents and purposes) of the semi-automatic gold standard, plans that called for a degree of managed flexibility and all plans that sought to expand the number of reserve currencies required attention to the degree of ade¬quacy or inadequacy in the supply of international monetary reserves.

So long as there is some element of exchange-rate management (adjustable pegs, wider bands), the availability of reserves, in one form or another, would be essential. There would similarly be a need for adjusting the aggregate supply of reserves over time to avoid excesses or deficiencies. Too little liquidity could threaten the attainment of the major objectives of intervention; while too much liquidity could, on the other hand, increase the likelihood of monetary authorities working at cross-purposes in their exchange-rate policies.

At stake was national autonomy, trust in institutions and in coordinated decisions by the leading monetary authorities regarding rates of change in total reserves and on the appropriate composition of these reserves. The cost of a high level of reserves was reduced national consumption and national investment in economic growth.

Hence, the first choice of Machlup and Dieterlen (and the only choice for Sohmen) was no reserve media. Proponents of a return to the gold standard, like Heilperin, preferred gold in the form of credit reserves. Gold bullion and credit reserves were the preferred choice of Harrod and the second best solution for Triffin, Hirsch, Moller and Dieterlen and the only choice for Salant, Uri, Kojima, deJongh, Dupriez, Halm, Mundell and Scitovsky. Credit reserves or automatic gold tranches, centralized within the IMF or other affiliated regional organization (for example, the OECD) was the first choice of proponents of centralized reserves, Triffin and Moller and the only choice for Salant, deJongh, Harrod, Day, Mundell and Scitovsky. Centralization of reserves within the IMF only was the second choice of Triffin, Machlup and Dieterlen and the only choice for Malkiel, Hirsch, Kenen and Halm. No Bellagio Group member preferred dollars or sterling as reserve media, although Harrod preferred reserves in eleven currencies and Dieterlen a mix of al currencies. Kojima and deJongh preferred a composite reserve unit to be held by the leading countries in a prescribed ratio to gold.

The rate of growth of reserves must not be so low as to exert deflationary pressures on the world economy nor so high as to encourage world inflation or to reduce the incentive for deficit countries to take appropriate adjustment measures. The conferees recognized, as in the case of the centralized-reserve plan, that closely coordinated decisions by the leading monetary authorities would be required for the successful functioning of such a system. Advocates of the semi-automatic gold standard and unlimited flexibility saw a cost to national autonomy in centralized and multi-currency approaches and dependence on supernational institutions that necessitated conditionality and surveillance.

Nearly all of the Bellagio Group members participating in the survey (with the exception of three who favored a one-time only gold price increase—Heilperin, Kojima and Harrod)—held that the growth and composition of reserves should be under international coordination and centralization. Proponents of this solution included Triffin (first choice); Machlup (second choice), Malkiel, Hirsch, Moller, Kenen, Uri, Kojima (his second choice), deJongh, Dieterlen, Dupriez, Halm and Mundell (who also suggested the enlargement of IMF quotas).

Confidence

Confidence, like liquidity, was essentially a reserves problem as defined by the Bellagio Group. Under the existing gold-exchange standard, the world had relied on a growth in dollar holdings for much of the increase in reserves. This same growth tended to impair the reserve position of the United States, increasing its short-term liabilities relative to its own reserves. An increase in the quantity of international reserves might consequently lead to a decline in their quality, as viewed by the monetary authorities holding these reserves.

In theory, the proposal for unlimited, unmanaged flexibility would have eliminated the need for reserves, and hence the confidence problem. But, in fact, some economists believed that unlimited flexibility of exchange rates might invite large destabilizing movements of private short-term capital. These could have powerful effects on the exchange rates, affecting prices and the allocation of resources and undermining confidence in the system. Hence, as seen in the liquidity discussion, additions to reserves became an almost universal requirement for Bellagio Group members.

All other plans sought to deal with one or both problems of confidence in reserve media (mostly dollars, although sterling was also a reserve asset). The first problem was that of the composition of reserves and the effects on overall value and gold holdings of substituting one reserve asset for another. The second problem was that of acquisition or disposal and the effects on overall value and gold holdings of dumping currency or redeeming currency for gold. In both problems, whether or not they were switching or disposing, all reserve holders might want to reexamine their positions and run down their dollar balances as well. A succession of conversions to gold would reduce the gross total of official reserves and would also compel the United States to take drastic action in defense of its own gold reserves.

Dieterlen, Dupriez and Mundell wished to induce reserve currency holdings through gold or exchange guarantees alone.

The proposals for centralization of international reserves sought to solve the problem of confidence in various ways. They called for the replacement of foreign-exchange balances by deposits at the IMF, so that central banks could no longer convert these currencies into gold. Further, they called for minimum deposit re-quirements; each country might be obliged to hold some fixed minimum of its total reserves in the form of interest-bearing IMF deposits. Critics of the multicurrency reserve plan saw major benefits in the plan for centralized reserves: depositor interest, gold-value guarantees on deposits, and guarantees against default. These would combine to protect the new international reserve-creat¬ing institution against a “run” on its own gold holdings. (In their view, central banks would even prefer IMF deposits to gold). This was Triffin’s first choice, the first choice of Kenen and the next best choice of Uri. It was also supported by Machlup, Malkiel, Salant, Hirsch and Moller.

The proposed multiple-currency-reserve plan would have supplied central banks with a wider range of assets, permitting them to diversify their reserve portfolios and thereby rendering them less sensitive to the possibility of changes in asset quality or changes in exchange rates. Further, it would have given them exchange-rate guarantees on their holdings of currency reserves in the form of reserve certificates in the form of reserve certificates. This was Uri’s first choice and the second best choice of Triffin, Kenen and Kojima. It was the only choice of Salant and Sohmen.

Others, however, though favoring the basic plan for centralized reserves, doubted that these provisions would solve the problem of confidence. They proposed that the new central-reserve institution (IMF) be spared any obligation to pay out gold, so that there could be no substitu¬tion of gold for deposits. Some preferred that this be done from the start, but considered it more practical to proceed gradually, limiting conversion step by step, for example, by raising the minimum deposit requirements at the central-reserve institution.

After a once-for-all increase in the price of gold that would permit the existing reserve-currency countries to pay off their obligations to other monetary authorities, it would then forbid monetary authorities to hold any international asset except gold. This was the preferred solution of Heilperin and Kojima. Once existing currency balances were liquidated, the monetary system would be safe from crises of confidence stemming from shifts in the composition of reserves.

Critics of this plan, however, pointed to a problem which is nearly analogous to the problem of confidence described above. If private individuals came to believe that the price of gold would be increased once again, they might begin to buy gold and drain reserves from all the central banks. Central banks would be compelled to allow a decline in the supply of money as their gold stocks fell, and this would depress world prices relative to the price of gold.

IV. OPPORTUNITY COST CONSIDERATIONS AND THE BELLAGIO GROUP “FINAL VOTE”

During each Bellagio Group conference, Machlup took the temperature of the members via surveys—asking them how their opinion on liquidity, adjustment, and confidence had changed, or how their exchange-rate regime choices had changed. Most of the surveys were mailed back to Machlup well after the conference, some were not returned at all, and few examples exist today. After the fourth conference, held May 29 through June 6, 1964, Machlup asked the Bellagio conferees to consider and rank order their preferred exchange-rate solutions, and adjustment, liquidity, and confidence mechanisms that would effectively knock out the payments adjustment, liquidity, and confidence problems. Robert Triffin calculated the results, as his handwritten notes reveal. Table 3 summarizes the conclusions of this survey.

Table 3. Summary: Adjustment, Liquidity and Confidence Mechanisms Preferred by Group—Triffin’s Calculations Based on Machlup’s Survey

|

The Triffin Plan for centralized reserves consolidated within the IMF with modified, flexible exchange rates emerged as the number one choice of conferees; the Triffin Plan alone emerged as number two (Robert Triffin Papers, MS 874, Box 12, folder 2). This survey was not published in the final report or anywhere else.

From Triffin’s viewpoint, the survey was an extremely useful tool. He noted that the proponents of the semi-automatic gold standard were primarily motivated by a deep distrust of government interference in economic life and its likely inflationary bias. Flexible rates were advocated by a much broader group, and for partly conflicting reasons.

Laissez-faire preferences were allied to a less optimistic… more realistic appraisal of the practical feasibility and negotiability of semi-automatic gold standard disciplines, particularly in relation to wage rate adjustments; equal—or greater—concern with dangers of deflation and unemployment as with dangers of inflation; nationalistic defense of one’s own country’s policies as likely to prove superior to other countries policies and to any internationally concerted policies; flexible rates thus preserving one’s own country’s policies against un¬requited international disciplines or deflationary (inflationary) impacts from abroad. (Robert Triffin Papers, MS 874, Box 12, folder 10).

Triffin noted that centralized reserves and multiple currency reserve problems stressed the reserve problem. “Most of their proponents… regarded themselves as in substantial agreement, and viewed as relatively minor, or secondary, the differences” between them. Triffin attributed the eradication of differences to work across centralized and multiple currency groups by Friedrich Lutz. A more significant difference between the sup¬porters of either of these two solutions should finally be noted: while all regarded as feasible and desirable a substantial amount of international discipline upon national policies, some (e.g. Salant) put most of their stress on generous provisions for deficit financing, while others emphasized the need for discretonary-lending aimed primarily at encouraging and supporting the adoption of compatible policies. (Robert Triffin Papers, MS 874, Box 12, folder 10).

In his “Report of the Nongovernmental Economists Study Group,” presented to the American Economic Association and published by the American Economic Review in 1965, Machlup would argue, “[A]dvocacy or rejection of flexible exchange rates rested to a large extent on assumptions regarding future attitudes of central bankers and private traders and investors. Concerning central bankers, the question is whether their resistance to inflationary pressures will or will not be reduced if the fear of dwindling international reserves is removed. Advocates of exchange rate flexibility assume that central bankers will fear drastic exchange depreciation under flexible rates no less than they fear reserve depreciation under fixed rates. Opponents of flexible rates assume that a loss of reserves always impresses central bankers for forcefully than would a drop in the exchange rate. Advocates of the semiautomatic gold standard want to remove the central banks’ power to meet a payments deficit by anything other than a sale of gold and to extend domestic credit to offset the deflationary effects of gold outflow. Advocates of flexible rates want to remove the central banks’ power to intervene in the foreign exchange market by official sales and purchases or to interfere by restrictions on private transactions (Machlup, 1965, p. 168–169).

V. CONCLUSION

The significance of the Bellagio Group approach, compared with the G-10 and IMF studies launched at the same time, lies primarily in its identification of adjustment, liquidity and confidence as the three overriding social objectives and its comparison of each in terms of the opportunity cost of the next best solution. This was built into the discussions and into the survey methodology. The Group of Ten and IMF reports fundamentally took liquidity as their objective and preservation of the existing fixed-rate, gold-based system as given. There was no focus on confidence in their reports. Bellagio Group members came into the discussion with reform plan preferences that included mild to wild alternatives.

The official inquiries also reflected a consensus view, as was their purpose. They were designed to seek agreement on courses of action and, ultimately, provide a platform for policy. There was no consideration of opportunity costs and second best solutions. The Bellagio Group study was designed to identify and interpret disagreement and to apply that disagreement to a consideration of the liquidity, adjustment and confidence problems. The iterative approach taken (every member worked on every aspect of the conferences and the final output), helped proponents of widely divergent views gain intimate familiarity with alternative plans right down to their very assumptions. Triffin would argue that the Bellagio Group discussions should have avoided the four reform plans and considered the three problems only. Machlup would surely have disagreed: the economists came to the table with preferred plans but without a focus on the three problems. The structure of the Bellagio Group conferences exposed the inadequacy of individual plans alone and focused the discussion on end goals to compromise was essential.

The Bellagio Group’s final report notes, “Among the valuable results of a study undertaken by experts known for their diametrically opposite recommendations may be the specification of the particular judgments of facts and objectives which are responsible for the conflicting conclusions. Perhaps some of the differences in judgments of fact can be resolved by further study, and some of the differences in judgments of value may be reduced by a non-emotive analysis of their places in a common hierarchy of higher goals” (International Monetary Arrangements, 1964, p. 6). In November 1965, Fritz Machlup received a letter from G-10 leader Otmar Emminger requesting the Bellagio Group’s aid in creating an environment for policy makers to discuss adjustment issues and recommendations. It would be the beginning of a 14-year collaboration with the first of 15 conferences planned for 1966.

APPENDIX

Table 2. Adjustment, Liquidity and Confidence Mechanisms Preferred

|

REFERENCES

Devries, Margaret. 1987. Balance of Payments Adjustment, Washington, D.C., International Monetary Fund.

Emminger, Otmar. 1978. “International Monetary Reform—Design and Reality.” In J. Dreyer, Breadth and Depth in Economics. Toronto: Lexington Books, pp. 173–80.

Haberler, Gottfried. 1977. “The International Monetary System After Jamaica and Manila.” In Contemporary Economic Problems. Washington, D.C.: American Enterprise Institute.

——. 1985. “The Theory of Comparative Costs and Its Use in the Defense of Free Trade.” In A. Koo (ed.) Selected Essays. Cambridge, UK: MIT Press: 3–19.

Kenen, Peter, 2000. “Chapter 12: Peter Kenen.” In R. Backhouse and R. Middleton, Exemplary Economists: North America. London: Edward Elgar Publishing, pp. 257–277.

Machlup, Fritz. 1933–1934. “A Note on Fixed Costs,” Quarterly Journal of Economics 48, no. 3: 559–564.

——. 1941. “Eight Questions on Gold,” American Economic Review 30, no. 5: 30–37.

——. 1942. “Competition, Pliopoly and Profit,” Economica, New Series 9, no. 33: 1–23.

——. 1947–1983. Papers, Hoover Institution Archives, Stanford, Calif.

——. 1950. “Three Concepts of the Balance of Payments and the So-Called Dollar Shortage,” Economic Journal 60, no. 237: 46–68.

——. 1958. “Can There Be Too Much Research?” Science, New Series 128, no. 3335: 1320–1325.

——. 1958. “Equilibrium and Disequilibrium: Misplaced Concreteness and Disguised Politics,” Economic Journal 68: 1–24.

——. 1965. “The Report of the Nongovernmental Economists’ Study Group,” American Economic Review 55: 166–177.

——. 1975. International Monetary Systems. New York: General Learning Press.

——. 1980. “Interview with Fritz Machlup,” Austrian Economics Newsletter 3.

——. 1982. “My Work on International Monetary Problems, 1940–1964,” Banca Nazionale del Lavoro Quarterly Review 140: 3–36.

Machlup, Fritz and the Bellagio Group. 1964. International Monetary Arrangements: The Problem of Choice. International Finance Section, Princeton, N.J., Princeton University.

Mises, Ludwig von. 1949. Human Action: A Treatise on Economics. London: William Hodge.

Solomon, Robert. 1977. The International Monetary System, 1945–1976: An Insider’s View, New York: Harper and Row.

Triffin, Robert. 1934–1978. Papers, Yale University, New Haven. Conn.

——. 1960. Gold and the Dollar Crisis. New Haven, Conn.: Yale University Press.

——. 1966. The Balance of Payments and the Foreign Investment Position of the United States. Essays in International Finance (Princeton, N.J.: International Finance Section, Princeton University.

——. 1978. “The Impact of the Bellagio Group on World Monetary Reform.” In J. Dreyer (ed.), Breadth and Depth of Economics: Fritz Machlup: The Man and His Ideas. Toronto: Lexington, pp. 145–158.

Wieser, Friedrich von. 1927. Social Economics. Trans. A.F. Hinrichs. London: Allen and Unwin.

- 1The G-10 were the industrial nations that agreed to participate in the General Arrangements to Borrow (Belgium, Canada, France, Italy, Japan, the Netherlands, the United Kingdom, the United States, the central banks of Germany and Sweden and Switzerland in 1964), effectively putting their own banks on the line for $6 billion (about $46 billion in 2013 dollars) to cover IMF loans to member (and sometimes non-member) nations with the consent of GAB members and the IMF’s Executive Board. New Arrangements to Borrow (NAB), first agreed upon in 1997 between the IMF and 25 (soon 26) high-income IMF member countries, was expanded in 2009, in response to the financial crisis, to 39 countries with a total commitment of $568 billion.

- 2These leaders were the Deputies of the Group of Ten countries, senior government finance and treasury officials, increasingly important to studies and reform of the international monetary system.